Top 100 Global Companies by Employees

Largest employers • global public-company snapshot

Employee headcount is a pure scale signal. It captures operating footprint, service capacity, and labor intensity across very different business models (retail, logistics, outsourcing, manufacturing, finance, telecom). It does not measure profitability or “quality” — only how many people the organization needs to run at its current size.

Dataset reference: CompaniesMarketCap “Companies ranked by number of employees” (public-company coverage). The platform reports a universe of 10,652 companies with a combined employee count of 131,872,687 in its snapshot.

Top 10 (quick cards)

The very top is dominated by labor-intensive retail and logistics, plus a small set of global-scale manufacturers and services firms. Think of this “top tier” as a map of where the world’s biggest operational workforces are concentrated.

Walmart

Amazon

BYD

JD.com

Foxconn (Hon Hai Precision Industry)

Accenture

Volkswagen

Tata Consultancy Services

DHL Group (Deutsche Post)

Compass Group

Top 10 table

Employee counts are shown as reported headcount in the snapshot. Use the table as a scale benchmark: cross-company definitions can differ (seasonal staff, part-time mix, consolidation boundaries, and how outsourced labor is treated).

| Rank | Company | HQ | Employees |

|---|---|---|---|

| 1 | Walmart | USA | 2,100,000 |

| 2 | Amazon | USA | 1,546,000 |

| 3 | BYD | China | 968,900 |

| 4 | JD.com | China | 900,000 |

| 5 | Foxconn (Hon Hai Precision Industry) | Taiwan | 826,608 |

| 6 | Accenture | Ireland | 791,000 |

| 7 | Volkswagen | Germany | 656,134 |

| 8 | Tata Consultancy Services | India | 607,979 |

| 9 | DHL Group (Deutsche Post) | Germany | 594,879 |

| 10 | Compass Group | UK | 580,000 |

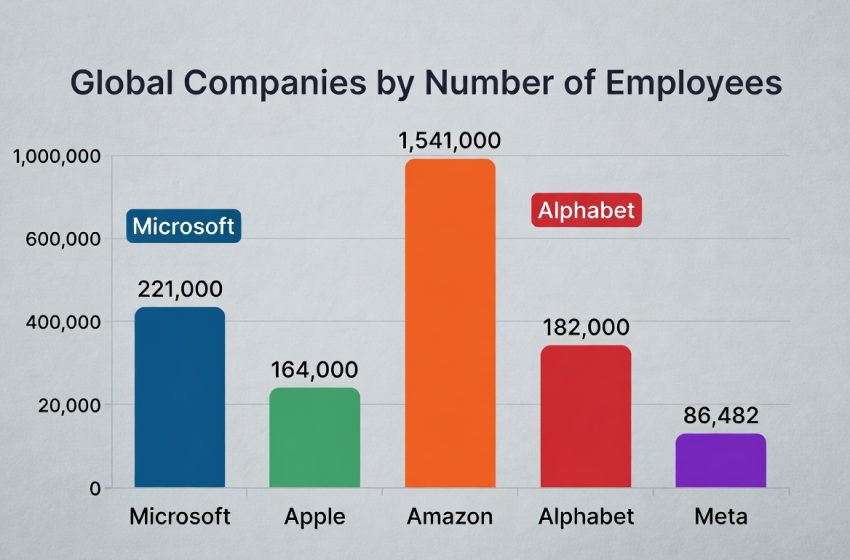

Chart: Top 20 by employees

Methodology (how this ranking is built)

The indicator is the reported employee headcount for each company in the snapshot. “Latest FY” is treated as the most recent headcount available in the dataset at the time of update. Employee reporting is not perfectly standardized across issuers, so the ranking is best read as a reproducible scale benchmark rather than a fully harmonized labor census.

The main comparability edge cases are structural, not statistical: (1) consolidation boundaries (which subsidiaries are included in the reporting group), (2) average headcount vs year-end headcount, (3) seasonal and part-time intensity in retail and logistics, (4) franchise models that move workers outside consolidated payroll, and (5) outsourcing and contractor-heavy operating models that can shrink reported headcount without shrinking operational activity. Those differences matter most when two firms are close in rank; they matter less when headcount differs by hundreds of thousands.

The design choice in this page is to keep the metric “pure”: companies are ordered by employees (descending). Supporting context is kept in narrative form (industry patterns, operating footprint, and model differences) so the reader can interpret scale without drifting into social claims or value judgments.

Key insights (business scale, not social commentary)

- Retail and fulfillment sit at the top because they require distributed execution. Store networks, warehouses, last-mile delivery, and customer operations scale through people and shift coverage.

- Manufacturing giants show up when the supply chain is physically wide. Large industrial workforces often reflect many sites, complex supplier ecosystems, and regulated safety processes.

- Outsourcing concentrates headcount behind contracts. Large IT/BPO platforms can appear “invisible” in consumer markets, yet they employ workforces comparable to national champions.

- Banking, telecom, and infrastructure groups remain large employers. Regulated operations, branch and network footprints, and customer-service obligations create structural staffing needs.

- Headcount is not a productivity ranking. It measures operational breadth and labor intensity. For productivity questions, pair it with revenue/profit per employee rather than reading headcount as output.

What this means for the reader

If you compare companies, employee scale is a practical proxy for operational complexity: the bigger the workforce, the more performance depends on scheduling, process discipline, compliance, and execution consistency across many sites and teams. If you track industries, headcount concentration is a useful pointer to where automation, software, and process redesign can materially reshape cost structures — especially in logistics, retail operations, and large-scale service delivery.

If you build competitive or market models, treat headcount as “capacity + coordination cost.” A one-million-employee organization is not just bigger; it has a fundamentally different management and control problem than a company with 50,000 employees. That difference can affect resilience to shocks, operational risk, and the speed at which a company can roll out changes across a global footprint.

FAQ (employees as a scale metric)

Why do retail and logistics dominate the very top?

Is “employees” comparable across companies?

Do contractors count as employees?

Why do franchise-heavy brands sometimes look smaller by headcount?

Can headcount fall while the business grows?

How often should a “latest FY” headcount ranking be refreshed?

Full Top 100 table (interactive)

Use search, region filters, and the Top 10/Top 20 toggle for faster scanning. The “Share” unit expresses each company’s headcount as a share of the Top 100 total. Without JavaScript, the full table remains visible and readable.

| Rank | Company | HQ | Employees / Share |

|---|---|---|---|

| 1 | Walmart | USA | 2,100,000 |

| 2 | Amazon | USA | 1,546,000 |

| 3 | BYD | China | 968,900 |

| 4 | JD.com | China | 900,000 |

| 5 | Foxconn (Hon Hai Precision Industry) | Taiwan | 826,608 |

| 6 | Accenture | Ireland | 791,000 |

| 7 | Volkswagen | Germany | 656,134 |

| 8 | Tata Consultancy Services | India | 607,979 |

| 9 | DHL Group (Deutsche Post) | Germany | 594,879 |

| 10 | Compass Group | UK | 580,000 |

| 11 | JD Logistics | China | 498,709 |

| 12 | United Parcel Service (UPS) | USA | 490,000 |

| 13 | Home Depot | USA | 470,000 |

| 14 | Gazprom | Russia | 468,000 |

| 15 | China Mobile | China | 455,405 |

| 16 | Agricultural Bank of China | China | 454,716 |

| 17 | Concentrix | USA | 450,000 |

| 18 | Teleperformance | France | 446,052 |

| 19 | Target | USA | 440,000 |

| 20 | ICBC | China | 419,252 |

| 21 | Marriott International | USA | 418,000 |

| 22 | Kroger | USA | 410,000 |

| 23 | UnitedHealth | USA | 400,000 |

| 24 | PetroChina | China | 398,440 |

| 25 | Berkshire Hathaway | USA | 392,400 |

| 26 | Fomento Económico Mexicano (FEMSA) | Mexico | 390,156 |

| 27 | Ahold Delhaize | Netherlands | 390,000 |

| 28 | Toyota | Japan | 389,144 |

| 29 | China Construction Bank | China | 376,847 |

| 30 | TJX Companies | USA | 364,000 |

| 31 | China State Construction Engineering | China | 361,249 |

| 32 | Starbucks | USA | 361,000 |

| 33 | Magnit | Russia | 357,000 |

| 34 | Sinopec | China | 355,952 |

| 35 | Cognizant | USA | 343,800 |

| 36 | TriNet | USA | 343,025 |

| 37 | Capgemini | France | 341,118 |

| 38 | Tesco | UK | 340,000 |

| 39 | NTT | Japan | 338,467 |

| 40 | Securitas AB | Sweden | 336,000 |

| 41 | Costco | USA | 333,000 |

| 42 | Siemens | Germany | 327,000 |

| 43 | X5 Retail Group | Netherlands | 325,000 |

| 44 | Infosys | India | 323,788 |

| 45 | PepsiCo | USA | 319,000 |

| 46 | Sodexo | France | 317,177 |

| 47 | JPMorgan Chase | USA | 317,160 |

| 48 | Bank of China | China | 312,757 |

| 49 | Insperity | USA | 306,023 |

| 50 | Carrefour | France | 305,309 |

| 51 | CK Hutchison Holdings | Hong Kong | 300,000 |

| 52 | FedEx | USA | 300,000 |

| 53 | Lowe's | USA | 300,000 |

| 54 | China Railway Group | China | 299,652 |

| 55 | Sumitomo Electric | Japan | 293,266 |

| 56 | Sberbank | Russia | 287,866 |

| 57 | Albertsons | USA | 285,000 |

| 58 | Vinci | France | 279,426 |

| 59 | China Telecom | China | 278,539 |

| 60 | Luxshare Precision | China | 278,103 |

| 61 | Ping An Insurance | China | 273,053 |

| 62 | IBM | USA | 270,300 |

| 63 | JBS | Brazil | 270,000 |

| 64 | Nestlé | Switzerland | 270,000 |

| 65 | Hitachi | Japan | 268,655 |

| 66 | Aramark | USA | 266,680 |

| 67 | China Railway Construction | China | 264,045 |

| 68 | Mahindra & Mahindra | India | 260,000 |

| 69 | ISS A/S | Denmark | 257,922 |

| 70 | Brookfield Corporation | Canada | 250,000 |

| 71 | Coal India | India | 248,550 |

| 72 | Stellantis | Netherlands | 248,243 |

| 73 | China Unicom | Hong Kong | 242,891 |

| 74 | Jardine Cycle & Carriage | Singapore | 240,000 |

| 75 | Reliance Industries | India | 236,334 |

| 76 | Walmart de México (Walmex) | Mexico | 235,132 |

| 77 | State Bank of India | India | 232,296 |

| 78 | Wipro | India | 230,000 |

| 79 | Citigroup | USA | 230,000 |

| 80 | Microsoft | USA | 228,000 |

| 81 | HCA Healthcare | USA | 226,000 |

| 82 | HCL Technologies | India | 223,420 |

| 83 | Japan Post Holdings | Japan | 221,387 |

| 84 | George Weston | Canada | 220,000 |

| 85 | Loblaw Companies | Canada | 220,000 |

| 86 | CVS Health | USA | 219,000 |

| 87 | HDFC Bank | India | 214,521 |

| 88 | DFI Retail Group | Hong Kong | 213,000 |

| 89 | Bank of America | USA | 213,000 |

| 90 | Wells Fargo | USA | 212,804 |

| 91 | HSBC | UK | 211,130 |

| 92 | Panasonic | Japan | 207,548 |

| 93 | Santander | Spain | 204,330 |

| 94 | Foxconn Industrial Internet | China | 202,818 |

| 95 | Veolia | France | 202,332 |

| 96 | Woolworths Group | Australia | 201,413 |

| 97 | LVMH | France | 200,518 |

| 98 | Bouygues | France | 200,200 |

| 99 | Jardine Matheson | Hong Kong | 200,000 |

| 100 | Deutsche Telekom | Germany | 198,678 |

Scatter: scale vs 30-day stock move (Top 20, context)

Interpretation, limitations, and sources

Employee headcount is a structural scale metric: it describes how wide a company’s operating system is — not how profitable it is and not how “good” it is. Use it to compare operating footprint and labor intensity across business models.

How to interpret “employees” as business scale

Headcount is one of the least model-dependent ways to describe how large an organization is in operational terms. A company with hundreds of thousands of employees typically has a broad physical footprint, multi-layer management, many sites and shifts, large compliance and safety systems, and high coordination load. In practice, this often means: more complex execution, more exposure to wage and staffing conditions, and a stronger dependence on process discipline.

- Operating footprint proxy: more people usually implies more sites, shifts, and operational dependencies.

- Labor cost exposure: large employers can be more sensitive to labor-market tightness and wage inflation.

- Execution bandwidth: headcount reflects how much real-world work is required to deliver the service at current scale.

- Coordination complexity: a workforce at this size requires systems for training, scheduling, governance, and quality control.

What the ranking usually tells you (and what it does not)

- It tells you where labor-intensive scale sits. Retail, logistics, manufacturing, and large service platforms rise because the operating model depends on people and physical coverage.

- It reflects business-model structure. Franchise-heavy brands can look smaller on consolidated headcount than their brand footprint; outsourcing can shift labor off payroll without shrinking activity.

- It is sensitive to corporate events. Mergers, divestitures, and reporting-perimeter changes can move a company materially in rank even if demand is stable.

- It is not a productivity ranking. High headcount does not imply high output per worker. For productivity, pair headcount with revenue/profit per employee.

- It is not a complete labor measure. Contractors, gig workers, and vendor staff can be economically central while remaining outside reported employee figures.

Method notes for a “latest FY” headcount snapshot

A “latest FY” table is strongest when it is explicit about reporting boundaries and timing. In this ranking, “latest FY” is interpreted as the latest headcount available in the dataset snapshot for each company at the update date. Fiscal-year endpoints differ across firms, so the table should be treated as a rolling snapshot rather than a single synchronized calendar-year census.

If a company’s headcount changes sharply year-over-year, the clean explanation is often structural rather than purely operational: consolidation boundary shifts, large acquisitions, divestments, or reclassification of employees across segments. Those shifts are a feature of real corporate reporting, and they are exactly why “employees” works best as a scale benchmark rather than a precision labor statistic.

Business takeaways (practical reading)

- Scale is not the same as valuation. Some of the world’s highest-valued firms employ far fewer people than retail and logistics giants, because business models differ in labor intensity.

- Automation leverage is uneven. Where headcount is very large, even small percentage efficiency improvements can materially shift cost structures and execution capacity.

- Operational risk is structural. Large workforces amplify the impact of scheduling, compliance, process quality, and staffing availability.

- Cross-country comparisons need context. Part-time share, seasonal intensity, and outsourcing patterns vary, so interpret tight rank gaps carefully.

Sources

-

CompaniesMarketCap — “Companies ranked by number of employees”

Primary table for the Top 100 snapshot (employee headcount, public-company coverage, and update timing).

companiesmarketcap.com/largest-companies-by-number-of-employees/ -

SEC EDGAR — annual reports (Form 10-K) for employee definitions and reporting context

Cross-check for headcount reporting notes (consolidation, part-time/seasonal mix, reporting date conventions).

sec.gov/edgar/search/ -

Company annual reports / investor relations pages

Edge-case validation for perimeter changes (M&A), segment reorganizations, and reporting convention changes.

One ZIP file with the tables and chart images used on this page.