Stock Market for Beginners: Where to Invest in 2025?

A guide to navigating the stock market for novice investors, highlighting key sectors, strategies, and opportunities in 2025.

The stock market offers a powerful avenue for wealth creation, but for beginners, it can seem daunting. In 2025, global equity markets are projected to grow moderately, with the MSCI World Index expected to deliver 5-7% returns, driven by stabilizing interest rates and technological advancements. Despite challenges like geopolitical tensions and inflation pressures, the market presents accessible opportunities for new investors. Global stock market capitalization reached $105 trillion in 2024, up 8% from 2023, reflecting resilience and investor confidence. This article provides a beginner-friendly overview of the stock market, key sectors to consider for investment in 2025, and practical strategies, supported by recent data and expert insights.

Understanding the Stock Market

The stock market is a platform where shares of publicly traded companies are bought and sold. For beginners, the primary goal is to invest in companies or funds that offer growth potential or steady returns. In 2025, retail investors account for 25% of global trading volume, up from 20% in 2020, thanks to user-friendly platforms like Robinhood and eToro. Key indices to watch include the S&P 500 (U.S.), FTSE 100 (UK), and NIFTY 50 (India), which reflect market trends.

Investing in 2025 requires understanding macroeconomic factors. The U.S. Federal Reserve’s interest rates, projected at 4-4.5%, influence stock valuations, while global GDP growth of 3% supports corporate earnings. Beginners should focus on diversification, low-cost investment vehicles, and long-term strategies to mitigate risks.

Where to Invest in 2025: Key Sectors

Several sectors stand out for their growth potential and stability, making them suitable for novice investors:

- Technology: Tech remains a powerhouse, with global IT spending projected to reach $5.1 trillion in 2025. Companies like Apple, Microsoft, and NVIDIA are leaders, with NVIDIA’s stock up 120% in 2024 due to AI demand. Cloud computing and cybersecurity firms, such as Amazon (AWS) and Palo Alto Networks, offer growth potential with 15-20% annual returns.

- Healthcare: The healthcare sector is resilient, driven by aging populations and innovation. Global healthcare spending is expected to hit $10 trillion by 2025. Stocks like Eli Lilly (weight-loss drugs) and UnitedHealth Group offer stability, with average returns of 8-12%. Biotech firms, such as Moderna, are riskier but have high growth potential.

- Renewable Energy: Clean energy is a growing sector, with global investment reaching $600 billion in 2024. Companies like NextEra Energy and Vestas Wind Systems are attractive, offering 10-15% returns. ETFs like the iShares Global Clean Energy ETF provide diversified exposure.

- Consumer Staples: Defensive stocks in consumer staples, such as Procter & Gamble and Walmart, provide stability during volatility. The sector delivered 5-7% returns in 2024, ideal for risk-averse beginners.

- Financials: Rising interest rates benefit banks and insurers. JPMorgan Chase and Allianz are strong picks, with projected returns of 8-10%. Fintech companies like Square (Block) add growth potential.

Investment Vehicles for Beginners

Beginners can choose from several investment options:

- Individual Stocks: Buying shares in companies like Apple or Tesla offers direct exposure but requires research. In 2024, 60% of retail investors held individual stocks.

- Exchange-Traded Funds (ETFs): ETFs like the Vanguard S&P 500 ETF (VOO) provide diversified exposure to broad markets or sectors. ETFs attracted $1.2 trillion in inflows in 2024, with expense ratios as low as 0.03%.

- Mutual Funds: Managed funds, such as Fidelity’s Growth Fund, offer professional oversight but higher fees (0.5-1%). They suit hands-off investors.

- Index Funds: Low-cost funds tracking indices like the S&P 500 delivered 7-9% annualized returns over the past decade.

- Robo-Advisors: Platforms like Betterment automate portfolios for beginners, with $50 billion in assets under management in 2024.

Regional Opportunities

Stock markets vary by region, offering diverse opportunities:

- North America: The U.S. market, with $50 trillion in capitalization, is driven by tech and healthcare. The S&P 500 returned 10% in 2024.

- Europe: European markets, particularly Germany and the UK, focus on industrials and financials. The STOXX 600 index yielded 6% in 2024.

- Asia-Pacific: India’s NIFTY 50 surged 15% in 2024, driven by IT and consumer goods. China’s CSI 300, despite volatility, offers value in renewables.

- Emerging Markets: Markets like Brazil and Vietnam provide high growth (10-12% returns) but higher risks. The MSCI Emerging Markets Index attracted $200 billion in 2024.

Challenges and Strategies for 2025

Beginners face challenges, including market volatility, with the VIX index averaging 20 in 2024, and inflation pressures at 3-4% globally. Geopolitical risks, such as U.S.-China trade tensions, could impact tech and consumer stocks. Emotional investing is another pitfall, with 40% of retail investors selling during 2024’s market dips.

Key strategies include:

- Dollar-Cost Averaging: Investing fixed amounts regularly reduces timing risks. In 2024, 70% of robo-advisor users employed this strategy.

- Diversification: Spreading investments across sectors and regions minimizes risk. ETFs are ideal for this.

- Long-Term Focus: Holding investments for 5+ years historically yields 7-10% annualized returns.

- Education: Using free resources like Investopedia or broker platforms improves decision-making.

Data Table: Top Sectors for Investment in 2025

| Sector | Projected Returns (%) | Key Stocks/ETFs | Risk Level |

|---|---|---|---|

| Technology | 15-20 | Apple, NVIDIA, QQQ ETF | High |

| Healthcare | 8-12 | Eli Lilly, XLV ETF | Moderate |

| Renewable Energy | 10-15 | NextEra, ICLN ETF | Moderate |

| Consumer Staples | 5-7 | Walmart, XLP ETF | Low |

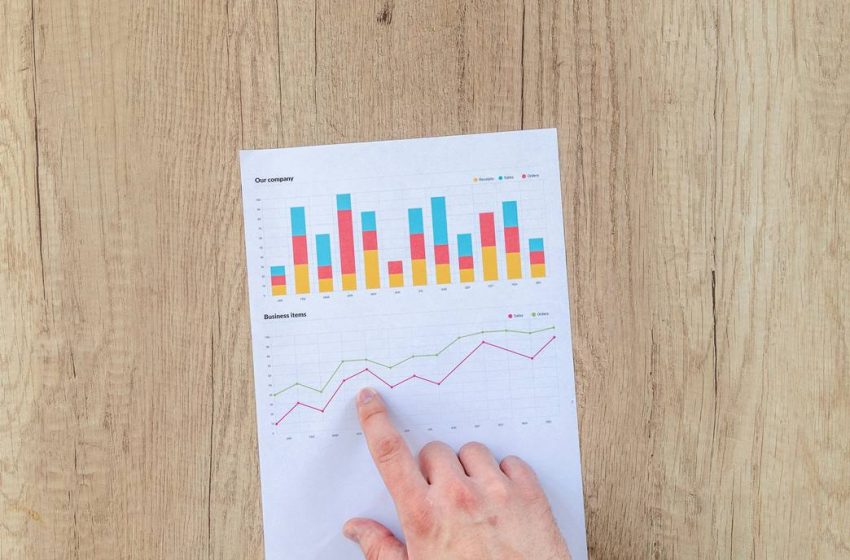

Chart: Sector Performance (2023-2024)

Note: Chart data is estimated based on Bloomberg, Morningstar, and industry reports (2023-2024).

Conclusion

In 2025, the stock market offers beginners accessible opportunities in technology, healthcare, renewable energy, and consumer staples. By leveraging ETFs, index funds, and robo-advisors, new investors can build diversified portfolios with manageable risks. Strategies like dollar-cost averaging and a long-term focus are key to navigating volatility. With education and discipline, beginners can capitalize on the market’s growth potential for sustainable wealth creation.

Sources

- Bloomberg - Global Equity Market Outlook 2025

- Morningstar - Sector Performance Analysis 2024

- U.S. Securities and Exchange Commission (SEC) - Investor Education and Market Data

- Reserve Bank of India (RBI) - Financial Market Trends 2025

- Organisation for Economic Co-operation and Development (OECD) - Equity Market Investment Trends