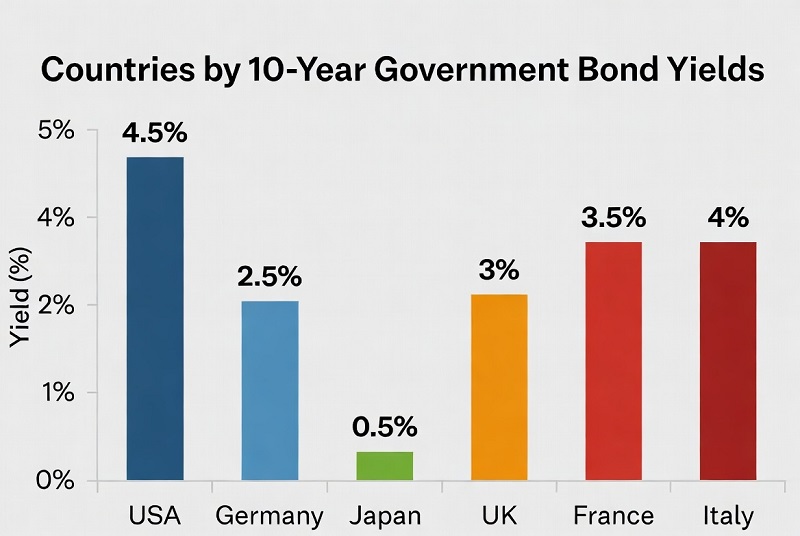

Countries by 10-Year Government Bond Yields

Countries by 10-year government bond yields (latest snapshot)

A 10-year government bond yield is a widely used benchmark for the long-term cost of sovereign borrowing. In most countries, higher 10Y yields translate into tighter financial conditions: governments refinance at higher rates, banks reprice loans, and corporate bond spreads often widen on top. Cross-country levels are not a “return leaderboard” — they are a fast read on inflation risk, fiscal risk, currency risk, and market liquidity premia embedded in long maturities.

Benchmarks are intended to be comparable long-term government yields; in some markets the closest maturity (roughly 8–12Y) is used when a clean 10Y line is not available.

Top 10 highest nominal 10Y yields

Top 10 table (quick scan)

| Rank | Country | Ref month | Yield (%) | Δ12m (bps) |

|---|

Top 20 yields (nominal %) — bar ranking

Methodology (how this snapshot is built)

What is included

Each country is represented by the latest available observation of a long-term government bond yield intended to approximate a 10-year benchmark. The reference month is shown for transparency. The 12-month change is calculated as: (current yield − yield one year ago) × 100, expressed in basis points (bps).

The ranking is designed to answer a practical question: who is paying the most to borrow for a decade right now, and is the market tightening or easing versus a year earlier. Because market structure differs across countries, the values should be read as a standardized snapshot rather than a perfectly controlled experiment.

- Liquidity differs. Thin local markets can show higher yields because large investors demand extra compensation to hold and trade duration risk.

- Issuance calendars differ. Supply pressure and redemption profiles affect the “term premium” embedded in long maturities.

- Currency regime matters. In local-currency debt, FX depreciation risk can be a meaningful part of the yield level.

Key insights (how to read the ranking)

1) High yields are a stress signal, not a gift

Double-digit 10Y yields usually reflect a layered premium: inflation uncertainty, a “higher-for-longer” policy path, and extra risk compensation for fiscal or currency concerns. The headline rate can look attractive, but what investors are being paid for is volatility and uncertainty, not a free lunch.

2) Δ12m shows direction — the level shows burden

A country can have a negative Δ12m (yields down year-on-year) and still remain expensive to finance if the level stays elevated. For debt dynamics, the level is the slow-moving “interest bill” problem; the change is the fast-moving “market regime shift” signal.

3) Advanced-economy yields are often term-premium driven

In deep markets, the 10-year yield is usually a blend of policy expectations and term premium (duration risk + supply), rather than default risk. That is why countries with very strong credit can still have higher long yields in tightening cycles.

What this means for readers

Households

Rising sovereign long yields commonly feed into higher mortgage rates and tighter credit. Even if your country’s policy rate is unchanged, long yields can reprice on inflation surprises or fiscal news and move borrowing costs across the economy.

Businesses

Sovereign yields anchor pricing for bank funding and corporate bonds. When long government yields climb, the cost of capital tends to rise, pressuring investment plans and refinancing.

Investors

Comparing yields across countries is only meaningful with context: inflation trend, currency exposure, and market liquidity. A high nominal yield can still imply low or negative purchasing-power returns if inflation is running hotter.

Full ranking table (coverage set)

This snapshot includes 40 economies with comparable long-term government benchmarks in the underlying dataset. Countries without a consistent benchmark and reference month are excluded rather than mixed into the same league table.

Countries by 10Y government bond yields (40 economies)

| Rank | Country | Ref month | Yield (%) | Δ12m (bps) |

|---|---|---|---|---|

| #1 | Brazil (BRA) | Sep 2025 | 13.69% | +142 bps |

| #2 | Colombia (COL) | Sep 2025 | 10.91% | −60 bps |

| #3 | South Africa (ZAF) | Sep 2025 | 10.31% | −30 bps |

| #4 | Mexico (MEX) | Sep 2025 | 9.03% | −67 bps |

| #5 | Romania (ROU) | Sep 2025 | 6.69% | +11 bps |

| #6 | Hungary (HUN) | Sep 2025 | 6.62% | −61 bps |

| #7 | Chile (CHL) | Sep 2025 | 5.71% | −87 bps |

| #8 | Poland (POL) | Sep 2025 | 5.59% | −40 bps |

| #9 | New Zealand (NZL) | Sep 2025 | 4.50% | −44 bps |

| #10 | United Kingdom (GBR) | Sep 2025 | 4.50% | +16 bps |

| #11 | Israel (ISR) | Sep 2025 | 4.35% | +23 bps |

| #12 | Czechia (CZE) | Sep 2025 | 4.25% | −4 bps |

| #13 | Australia (AUS) | Sep 2025 | 4.24% | −5 bps |

| #14 | USA (USA) | Sep 2025 | 4.20% | −6 bps |

| #15 | Bulgaria (BGR) | Sep 2025 | 3.73% | −36 bps |

| #16 | Norway (NOR) | Sep 2025 | 3.62% | −46 bps |

| #17 | Lithuania (LTU) | Sep 2025 | 3.55% | −24 bps |

| #18 | Estonia (EST) | Sep 2025 | 3.51% | −37 bps |

| #19 | Italy (ITA) | Sep 2025 | 3.46% | −39 bps |

| #20 | Latvia (LVA) | Sep 2025 | 3.45% | −23 bps |

| #21 | Greece (GRC) | Sep 2025 | 3.42% | −20 bps |

| #22 | Portugal (PRT) | Sep 2025 | 3.25% | −27 bps |

| #23 | Canada (CAN) | Sep 2025 | 3.21% | −10 bps |

| #24 | Croatia (HRV) | Sep 2025 | 3.19% | −30 bps |

| #25 | Spain (ESP) | Sep 2025 | 3.11% | −27 bps |

| #26 | Slovakia (SVK) | Sep 2025 | 3.06% | −29 bps |

| #27 | Slovenia (SVN) | Sep 2025 | 3.01% | −25 bps |

| #28 | Belgium (BEL) | Sep 2025 | 2.95% | −12 bps |

| #29 | France (FRA) | Sep 2025 | 2.91% | −18 bps |

| #30 | Luxembourg (LUX) | Sep 2025 | 2.89% | −23 bps |

| #31 | Austria (AUT) | Sep 2025 | 2.87% | −16 bps |

| #32 | South Korea (KOR) | Sep 2025 | 2.81% | −29 bps |

| #33 | Finland (FIN) | Sep 2025 | 2.72% | −24 bps |

| #34 | Netherlands (NLD) | Sep 2025 | 2.62% | −23 bps |

| #35 | Germany (DEU) | Sep 2025 | 2.60% | −22 bps |

| #36 | Denmark (DNK) | Sep 2025 | 2.58% | −36 bps |

| #37 | Sweden (SWE) | Sep 2025 | 2.41% | −33 bps |

| #38 | China (CHN) | Sep 2025 | 1.77% | −48 bps |

| #39 | Japan (JPN) | Sep 2025 | 1.44% | +53 bps |

| #40 | Switzerland (CHE) | Sep 2025 | 0.60% | −4 bps |

Scatter: yield level (%) vs 12-month change (bps)

How to interpret “highest government bond yields”

A sovereign 10-year yield is not one variable — it is a bundle of expectations and risk compensation. Markets start with a baseline for time value and uncertainty, then add (or subtract) premia depending on inflation credibility, fiscal trajectory, currency risk, and local market depth. That is why a “high yield” can mean different things across countries.

What usually sits inside the 10-year yield

Inflation expectations

If investors expect higher inflation over the next decade, they demand a higher nominal yield to protect purchasing power. Countries with volatile inflation histories often pay a persistent inflation premium even when recent inflation improves.

Policy path and term premium

The 10-year yield embeds a market view of the future policy-rate path plus a term premium for holding long duration under uncertainty. Supply, volatility, and growth risks can lift term premia even in strong-credit sovereigns.

Fiscal, FX, and liquidity premia

Higher deficits, refinancing pressure, and weaker debt credibility can add a fiscal premium. In local-currency markets, currency depreciation risk can also be priced in. Thin secondary markets often carry an additional liquidity premium.

Real yields: useful lens, careful comparisons

A practical approximation is real ≈ nominal − inflation. It helps separate “high because inflation is high” from “high because investors demand extra risk compensation.” The key requirement is consistency: CPI definition and timing must match the same reference month as the yield.

For economies with very high inflation volatility, a single-month YoY CPI can swing sharply; interpreting “real yield” requires broader context.

Policy takeaways: what tends to lower long yields sustainably

- Credible inflation control reduces the inflation premium embedded in long yields.

- Clear fiscal anchors (medium-term debt and deficit paths) compress fiscal risk premia.

- Debt-management strategy that smooths maturities and supports liquidity lowers rollover and liquidity premia.

- Transparency around debt composition, contingent liabilities, and auction plans improves pricing confidence.

FAQ — 10-year government bond yields

Why do some countries have much higher 10Y yields than others?

Is the “highest yield” automatically the best investment opportunity?

What does a 12-month change in bps tell me?

Why can yields fall even if borrowing is still “expensive”?

How should I compare advanced economies vs emerging markets?

Why do different sources sometimes show slightly different yields?

What’s the cleanest next step if I want real yields by country?

OECD Data — Long-term interest rates Developed-market benchmark series

Harmonized long-term interest rate series for OECD members, commonly used as a cross-country reference for government yield comparisons. Useful for consistent definitions and regular updates across advanced economies.

Open sourceIMF Data (IFS / WEO) Inflation and macro series

Standardized macroeconomic datasets used to align inflation measures and provide cross-country context. WEO is commonly used for internationally comparable inflation vintages; IFS provides broader time-series coverage where available.

Open sourceWorld Bank Data Definitions and cross-country metadata

Reference repository for macro definitions and country metadata. Useful for harmonized context variables and for checking indicator definitions when combining datasets.

Open sourceNational central banks / debt management offices Instrument details

The authoritative source for the exact benchmark instrument (maturity, auction calendar, on-the-run status, and market conventions). These sources are used to validate which security is treated as the closest long-term benchmark when a clean 10-year series is not available.

Download: Countries by 10-Year Government Bond Yields (tables + charts)

This archive includes ready-to-use tables (CSV/HTML/JSON) and chart images used in the article snapshot.

- Top 10 table (CSV + HTML)

- Top 20 table (CSV + HTML)

- Full table (coverage set) (CSV + HTML + JSON)

- Charts: Top 20 bar + scatter plot (PNG)

- README with column definitions

Snapshot format: latest available month per country (most series in this snapshot reference Sep 2025). Values reflect nominal 10Y yield (%) and Δ12m (bps).

admin (Website)

administrator