Top 50 U.S. States by GDP (Nominal) — 2026 Update (2024 data)

This ranking uses current-dollar (nominal) gross domestic product by state from the U.S. Bureau of Economic Analysis (BEA). “Current dollars” is the standard nominal measure: it values production at prices of the same year, so it reflects both real output and price changes. If your question is “which states have the largest economies in dollar terms,” nominal state GDP is the right tool.

The latest annual benchmark in the BEA state GDP release is 2024 (preliminary). National GDP in 2024 was $29.18T in current dollars, up 5.28% versus 2023. At the state level, the distribution is concentrated: a small group of mega-states accounts for a large share of total output, while many states form a long tail with small individual shares.

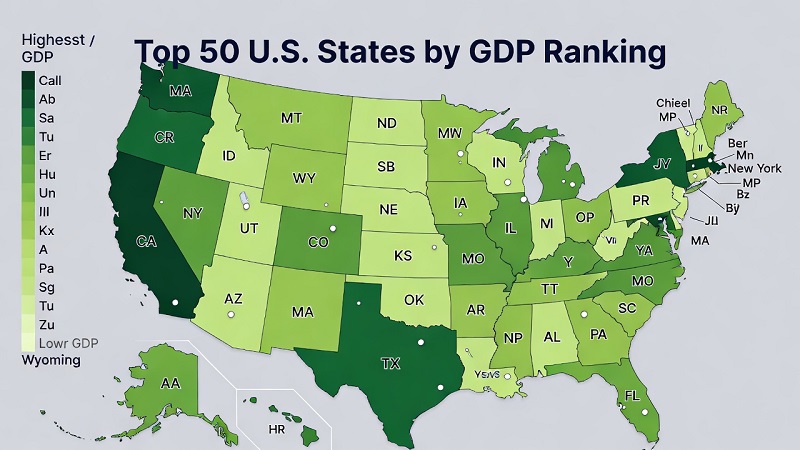

Key takeaways

- California, Texas, and New York are the three largest state economies in nominal terms (2024 preliminary).

- Only 6 states exceed $1T in annual GDP: California, Texas, New York, Florida, Illinois, Pennsylvania.

- By BEA region, the Southeast is the largest block by level (≈ 22.23% of U.S. GDP), followed by the Far West (≈ 19.65%).

- Nominal growth (2023→2024) mixes real activity and prices; use BEA “real GDP” (chained dollars) for inflation-adjusted comparisons.

Top 10 states (nominal GDP, 2024 preliminary)

| Rank | State | GDP 2024 | Share of U.S. | YoY (2024 vs 2023) |

|---|

Chart 1 — Top 20 states by nominal GDP (2024)

If the chart doesn’t render, use this Top 20 list (T = trillions)

- 1. California4.10T

- 2. Texas2.71T

- 3. New York2.30T

- 4. Florida1.71T

- 5. Illinois1.14T

- 6. Pennsylvania1.02T

- 7. Ohio0.93T

- 8. Georgia0.88T

- 9. Washington0.85T

- 10. New Jersey0.85T

- 11. North Carolina0.84T

- 12. Massachusetts0.78T

- 13. Virginia0.76T

- 14. Michigan0.71T

- 15. Colorado0.55T

- 16. Arizona0.55T

- 17. Tennessee0.55T

- 18. Maryland0.54T

- 19. Indiana0.53T

- 20. Minnesota0.50T

Why “nominal”: current-dollar GDP answers a scale question — how many dollars of production are attributed to each state in the year. If you need inflation-adjusted performance comparisons, use BEA’s “real GDP” (chained dollars) series instead.

Full ranking — all 50 states (nominal GDP, 2024 preliminary)

Search, sorting, and filters. Switch the main metric between GDP level and share of U.S. total.

| Rank | State | GDP 2024 ($B) | YoY (2024 vs 2023) |

|---|

Chart 2 — Size vs growth (nominal GDP, 2024 vs 2023)

X-axis: 2024 GDP (T). Y-axis: YoY change (%). Each dot is a state.

Fastest nominal GDP growth (2023→2024)

| Rank | State | YoY |

|---|

Slowest nominal GDP growth (2023→2024)

| Rank | State | YoY |

|---|

Reading tip: a high YoY in a small state doesn’t move the national total much; a modest YoY in a mega-state can matter more in dollar terms.

How to interpret the results

A “state GDP” ranking is a compact way to describe economic scale, but it is not a full scorecard of prosperity. GDP measures the value of production attributed to a place — it does not directly measure household income, wages, inequality, fiscal capacity, or cost of living. A state can rank very high in GDP because it hosts a large concentration of corporate headquarters, high-value services, capital-intensive industries, or large populations; that does not automatically mean the median household is “better off.” Still, nominal GDP is extremely useful whenever the size of an economy matters: market sizing, understanding where national output is concentrated, and identifying which states can materially move U.S.-wide aggregates.

The headline story in 2024 (preliminary) is concentration. The top five states generate about 41% of U.S. GDP in current dollars, and the top ten account for roughly 56.5%. That implies a practical rule of thumb: if you want to understand movements in national current-dollar output, you start with the mega-states — California, Texas, New York, Florida, and Illinois — because even “ordinary” percentage changes in those states translate into very large dollar moves. Meanwhile, the long tail matters in a different way: the bottom ten states together contribute only about 2.7% of total output, so even a very strong YoY rate there won’t shift the U.S. total much.

It also helps to separate level from growth. Level answers “How large is the economy?” Growth answers “How quickly did it change from last year?” In nominal terms, the growth rate combines real activity and price effects. That means a state’s nominal GDP can rise quickly during a year of higher prices in key sectors, even if inflation-adjusted output is much less impressive. Conversely, nominal growth can look weak in an energy-heavy state during a price downshift, even if some parts of the real economy are stable. If your goal is performance benchmarking, the BEA “real GDP” series (chained dollars) is the correct companion measure.

Finally, treat small rank changes between adjacent states cautiously. BEA annual estimates for the latest year are preliminary and can be revised as more complete source data arrive. Revisions are normal, especially for states where certain industries are volatile or where timing effects (for example, large projects or inventory swings) can shift the annual profile. The cleanest way to use this page is: (1) treat it as a scale map of the U.S. economy in current dollars, and (2) combine it with real GDP or per-capita metrics when you need “performance” or “living standards” interpretations.

Methodology

- Metric: GDP in current dollars (nominal), annual, by state (BEA “GDP by State”).

- Latest year used: 2024 (preliminary). Comparison year for YoY is 2023.

- Units: BEA reports GDP levels in millions of dollars. This page formats levels into $B and $T.

- Ranking rule: states ranked by 2024 GDP level (descending). District of Columbia is excluded to keep the list at 50 states.

- YoY growth: calculated as (GDP_2024 / GDP_2023 − 1) × 100 using annual levels.

- Share of U.S. total: calculated as GDP_state_2024 / GDP_US_2024 × 100 (annual totals).

- Regions: BEA regions (New England, Mideast, Great Lakes, Plains, Southeast, Southwest, Rocky Mountain, Far West) are used for filtering.

- Revisions: 2024 values are preliminary and may be revised in later BEA releases.

If you need an inflation-adjusted comparison, use BEA “real GDP” (chained dollars) or the percent changes in real GDP included in the same release. This page intentionally focuses on nominal GDP because the ranking target is “GDP (nominal).”

Sources

-

BEA — News release: Gross Domestic Product by State and Personal Income by State, 4th Quarter 2024 and Preliminary 2024

https://www.bea.gov/news/2025/gross-domestic-product-state-and-personal-income-state-4th-quarter-2024-and-preliminary -

BEA — Tables Only (Excel): stgdppi4q24-a2024.xlsx (Table 1 includes annual current-dollar GDP levels)

https://www.bea.gov/sites/default/files/2025-03/stgdppi4q24-a2024.xlsx -

BEA — GDP by State topic page (definitions & related materials)

https://www.bea.gov/taxonomy/term/461

FAQ

Is “GDP by state” the same as a state government budget or revenue?

No. State GDP is the value of production attributed to a state’s economy. Government revenue and budgets are fiscal measures that depend on tax systems, federal transfers, and policy choices. A state can have a large GDP and still have a relatively modest state budget as a share of output (and vice versa).

Why can nominal GDP grow fast even when people don’t feel richer?

Nominal GDP includes price effects. If prices rise in major sectors (or if a state’s industry mix experiences stronger price growth), nominal GDP can increase even if inflation-adjusted output is less impressive. Household experiences depend more directly on wages, prices, and distribution.

Why exclude the District of Columbia?

The District of Columbia has a unique economic structure and governance model compared with states. This page keeps the ranking to the 50 states for a clean, comparable list. If you include DC, it would appear among mid-to-high ranks by nominal GDP.

Do ranks change a lot from year to year?

Large rank shifts are uncommon among the biggest states because the gaps are wide. Smaller rank changes can happen among mid-sized states, especially when certain industries are volatile or when BEA revises preliminary estimates. Adjacent ranks should be interpreted with revision risk in mind.

What should I use for “economic performance”: nominal GDP, real GDP, or per-capita GDP?

Use nominal GDP for “size in dollars,” real GDP for inflation-adjusted output changes, and per-capita GDP to compare output scale relative to population. In practice, a complete performance view usually combines real growth with per-capita measures and complementary indicators like income and employment.